Life insurance is a topic that seems to come up quite a bit, either on the radio, with your local independent insurance agent, or on television; but do you really know that much about it? There is much speculation about how much life insurance one needs or if you even need it at all, so this topic can be rather intimidating, but doesn’t have to be. Find out how much life insurance is enough for you so you can stop the questioning.

Life insurance is a topic that seems to come up quite a bit, either on the radio, with your local independent insurance agent, or on television; but do you really know that much about it? There is much speculation about how much life insurance one needs or if you even need it at all, so this topic can be rather intimidating, but doesn’t have to be. Find out how much life insurance is enough for you so you can stop the questioning.

Plan Today for Tomorrow’s Unexpected

You work hard every day to provide for your family financially and without your income, your family’s lives may change immensely. The first aspect to consider when planning for life insurance is simply this. Would your family be able to financially survive if something detrimental happens to you? If your answer is NO, then continue reading.

There is no magic formula for factoring the amount of life insurance you need for your family, although in the past you may have heard some “rule of thumbs” by which to figure. Every family situation is different; therefore the amount of life insurance you decide upon will vary family-to-family and budget-to-budget. There are some basic features that every family can take into consideration and discuss with their local N.C. independent insurance agent to come up with a life insurance plan that will provide the needed protection for your family, within a budget you can afford.

Below Are Just Some Considerations to Contemplate When Planning Your Life Insurance, but Not Limited to:

Funeral Costs- When you factor in the costs of a funeral, estate handling, burial or cremation, you may be shocked. These expenses can be very costly.

Monthly Bills/Fees- These fees include monthly mortgage payments, car payments, utilities, education, and other fees paid on a monthly basis.

Future Anticipated Bills- You must also consider any future anticipated expenses for your family such as college/education costs, travel, and potential relocation.

Current Salary/Future Anticipated Salary- Consider not only your current income, but also what you would anticipate down the road in your profession, such as raises, likely promotions, etc.

Hidden Income Costs- This type of income is above and beyond your salary and may be in the form of a retirement plan or investment(s).

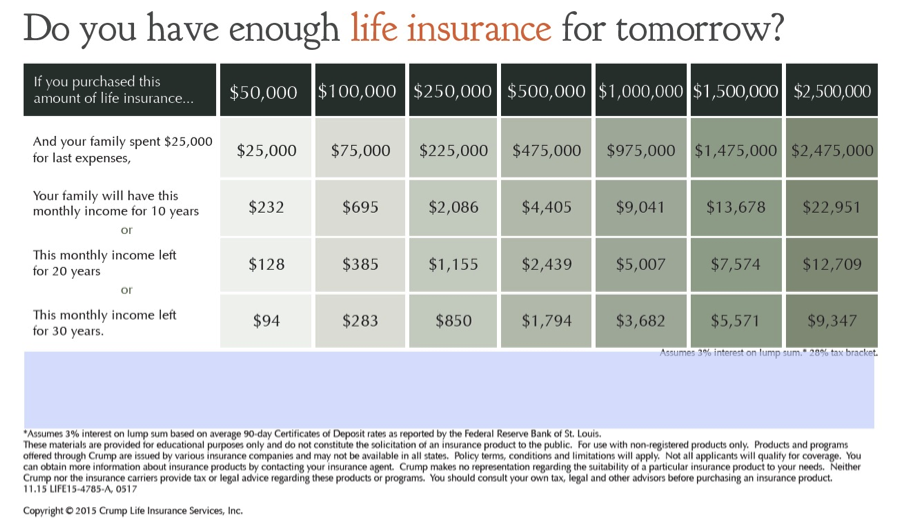

Below is a chart to help give you an idea of life insurance amounts and what may be used as a “guideline” for you. However, it is always best to do your research and make a list of questions to discuss with your N.C. independent insurance agent to get the best life insurance for your specific needs.

Protect Your Family Today!

Nobody likes to think about the unexpected nature of “life”, but at any given moment, life can end and with that, so does the financial support. The time to prepare for life insurance is BEFORE that happens. Your family depends on it! For further information, call our office TODAY at 866-869-3335 to discuss your life insurance options.

Tom's Blog

Tom's Blog